Several months have passed since my last analysis of the aluminium market. This raises the natural question: has anything changed, what is currently happening in the market and what are the forecasts for the near future? Is it worth invest in aluminium and wait for prices to rise, or be cautious? What about scrap metal pricescasting alloys, rims, as well as so-called premium aluminium - such as profiles, food grade aluminium or other homogeneous alloys? The final investment decisions remain with you, but below are my current observations and forecasts.

Premium aluminium market

Analysing premium aluminium market, it is important to look beyond European foundry prices. Of key importance here are:

- price of primary aluminium (primary aluminium),

- the cost of its manufacture,

- and, in the longer term, implemented CBAM system, or carbon footprint charges for aluminium imported from outside the EU.

In my view, in the next 2-3 months there is a real risk of falling premium aluminium prices. Currently, the premiums offered by foundries for premium scrap exceed by approx. 70 EUR/t price of the original goose. It is worth asking the question: why do foundries pay more for scrap than for pure aluminium with guaranteed chemical composition and certificates? The answer: they are trying to reduce CO₂ emissions and align their products with the requirements of the 'green industry'. However, financial pressures can quickly verify these ambitions - if margins fall below the expected level of owners.

In addition, the demand situation is unstable, with many sectors, especially construction, in crisis. This has a direct impact on the demand for profiles, sheets and other aluminium-based products.

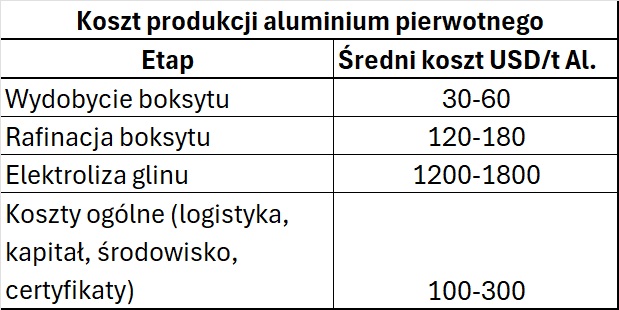

As for the possible the fall in the price of primary aluminium on the LME - there is still room for reductions. Depending on the energy source and production region, the cost of producing 1 tonne of aluminium varies between USD 1450 and USD 2300. For comparison - the price of primary gooseberries in Rotterdam after premium and duty is now in excess of EUR 2800/t.

Aluminium market analysis

Considering:

- holiday restrictions on the supply of scrap metal,

- reduced foundry activity,

- and the general economic downturn,

I expect that premium scrap prices during the holiday season will be linked to the level of LME HG quotations. After the holiday season, foundries can be expected to start reducing premiums to narrow the gap between scrap and primary aluminium.

Aluminium market for the production of cast alloys

Foundry alloy market is currently characterised by a relative stabilisation of goose prices, but with a clear lack of demand. The key producers in Poland have untapped production potential and are struggling with a limited number of orders. The market is heavily dependent on the automotive industry, the condition of which - especially for combustion vehicles - can hardly be considered good.

At the same time, it is worth looking at prices of alloying elements, particularly silicon, which is an important component of casting alloys. W 2025 Its prices have fallen by several to several per cent, depending on the source.

In addition to raw material prices, the situation is also influenced by:

- energy and gas costs,

- scrap supply,

- and the general health of European industry.

The summer season is traditionally associated with reduced production activity, holiday breaks and weaker demand. For this reason, we believe that prices for rims, plastics and cast alloys will gradually decrease during the summer holidays. The magnitude of these changes will mainly depend on scrap availability.

How to make money from Aluminium in a Falling Price Environment?

In an expected situation the fall in prices, a strategy of caution seems the most sensible. I propose:

- build a safe margin,

- avoid speculation,

- sell material on an ongoing basis, even in smaller batches,

rather than hoarding it in the hope of increases that may not come.

It is better to operate with liquidity and flexibility than to run the risk of losses from a sudden market collapse.

Summary

The aluminium market faces many challenges today - from regulatory changes (CBAM), to environmental pressures, to the economic downturn and the crisis in demand-critical industries. In the short term, I do not foresee sharp price increases. Rather, I expect stabilisation or declines, both in the premium aluminium and cast alloy markets. I would rather expect significant changes towards the end of IQ2026 after the CBAM levies (€60-80/tonne) come in.

Beyond substantive analyses, we need to remember politics, tariffs, wars. They can turn the tables upside down.

14.07.2025 - RM