Anyone operating on a larger scale in the non-ferrous scrap metal trade has certainly encountered offers to purchase copper (e.g. milberry or cathode) from exotic countries - particularly Africa or less developed areas of Asia. Often these offers are unbelievably good value for money, while backed up by assurances of legality and willingness to cooperate. Almost everyone who has come across them has lost at least time - and, unfortunately, many also money.

I myself, a few years ago, tempted by the vision of a quick and easy profit, also fell victim to manipulation. Fortunately, I only lost time, not financial resources. There is an important lesson to be learned from that lesson: there is no easy money in tradeand double-digit margins on legal copper are a fiction. Despite this, many market participants continue to succumb to the illusion of quick profits, unwittingly supporting global criminal structures.

The pattern is usually similar. A metal trading company is approached by a supposed producer or middleman - offering copper in the form of cathode, wire rod or scrap. This often comes from 'hard-to-reach' countries and the price is significantly lower than the market.

The fraudster sends photos of the material, often with the potential buyer's name and the current date, suggesting that everything is prepared and ready for shipment. In addition, he declares that he is ready to deliver to port, can use independent inspectors and shows a high level of commitment - which is supposed to make the whole transaction credible.

It does not ask for money up front - it only asks for an opening letters of credit as a form of security.

A Letter of Credit (LC) is an undertaking by a bank acting on behalf of the buyer (importer) to pay the seller (exporter) a specified amount - subject to the presentation of documents in accordance with the terms of the LC. It is one of the most commonly used instruments in international trade to secure transactions.

In a nutshell: if the seller provides a set of documents as agreed, the bank will pay the money - regardless of whether the goods actually arrive.

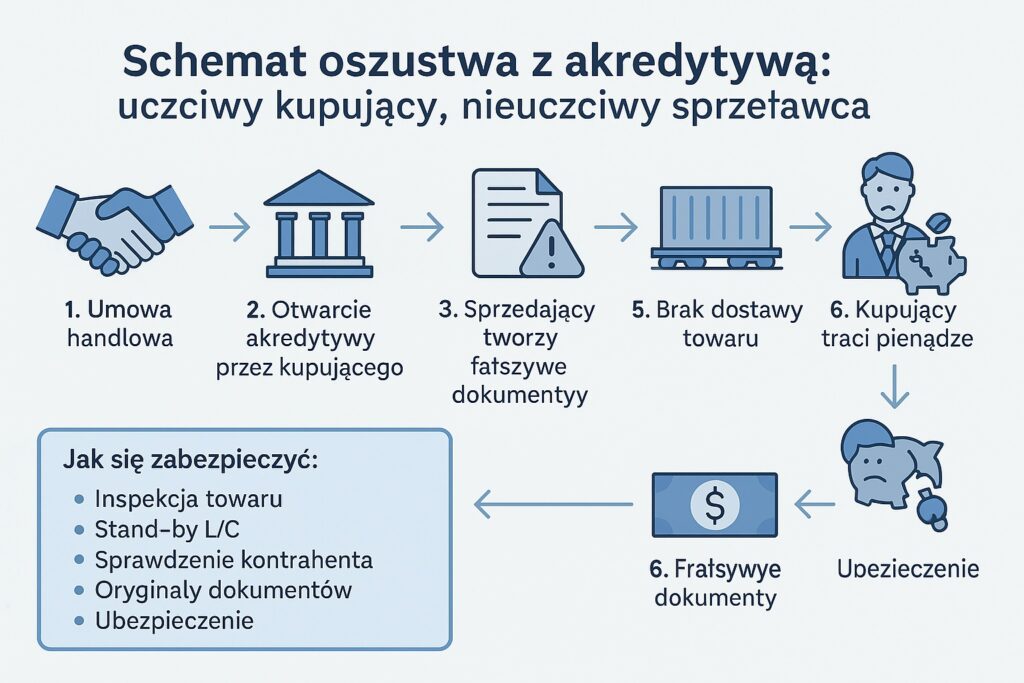

The pattern of a fair transaction with a letter of credit is as follows:

- The buyer and seller enter into a commercial contract.

- The buyer instructs the bank to open a letter of credit in favour of the seller.

- The buyer's bank sends the letter of credit to the seller's bank.

- The seller sends the goods and provides the required documents (invoice, waybill, certificates).

- The bank analyses the documents - if they are correct, it disburses the funds.

- The buyer receives the documents and picks up the goods.

In the case of fraud, everything runs almost identically - except that:

- the goods are not sent at all, or

worthless material is sent (e.g. steel wire instead of copper - an example can be seen in the video: https://youtube.com/shorts/niSJCBoMAQg

A letter of credit is a fully legal and accepted banking instrumentwhich is based solely on documents. Fraudsters take advantage of this fact by presenting false or manipulated shipping documents, invoices and quality certificates - and thus legitimately receive money. The crime is only revealed when the buyer does not receive the goods - or receives something completely different.

Illegal uses of letters of credit by criminal groups:

- Documentary fraud

False documents allow funds to be defrauded without actual delivery. - Extortion of credit

A fictitious letter of credit can be used as security for a loan from a bank. - Money laundering

The money is legalised through fictitious contracts and the circulation of documents. - Financing of criminal or terrorist activities

Complex company and transaction structures are used to hide cash flows. - Bypassing economic sanctions

Letters of credit help conceal the actual recipients or origin of goods.

In an age of globalisation, copper is a raw material that can be sold in any part of the world - an honest seller there is no need to offer it below market price. So if you receive an offer to buy cathodes, scrap metal or wire rod from 'exotic' locations at a suspiciously low price - take this as a warning signal.

Before you commit time, energy and trust to such offers -. think twicewhether it is worth it. Not only could you lose money, but you could - unknowingly - become part of a wider criminal enterprise.

RM 07.2025